- Home

- About Me

- YouTube Channel

- Free Live Trade Videos

- Free Educational Videos

- FAQ

- FREE MCA mini course

- Blog

- Forum

- Selected Brokers

- My Book

- Commercial Area

- Other

- Economic Calender

- FX Prices

- FX News

- Trading Hardware

- Trading Software

- FREE tools

- Realistic Backtesting

- EA Tracking

- Academic Papers

- Useful links

- Multifractality and FX

- Black Swan Events

- Affiliates & Partners

- Trade Contests

- Connect to professional FX traders

- Events

- Auto Trading

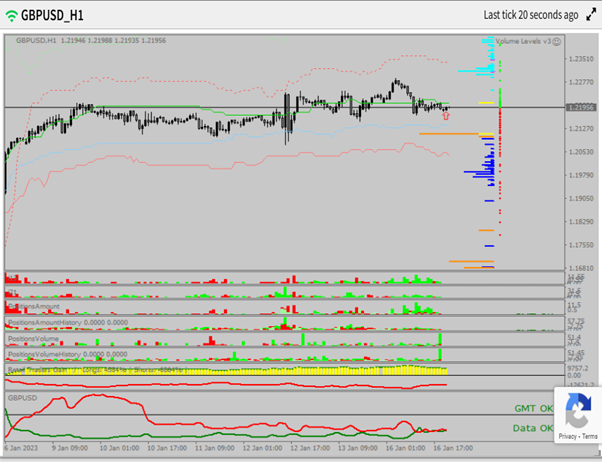

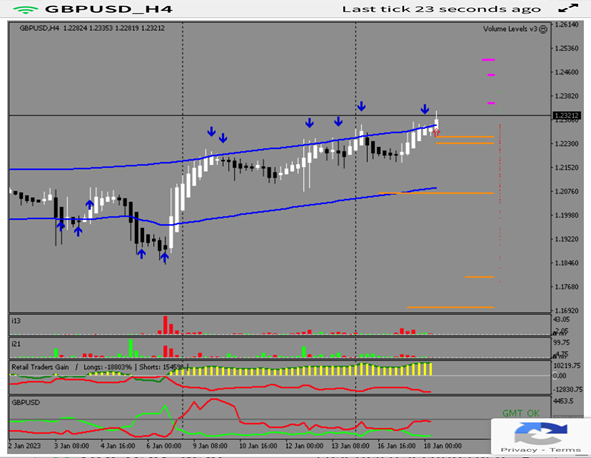

- FX Watch

- ‘TRADER to TRADER’ Podcast